Behind the Scenes of Sneaker Reselling: A Multibillion-Dollar Industry

Individuals have generated significant revenue, ranging from thousands to millions of dollars, from reselling these coveted shoes.

Introduction:

In recent years, a remarkable transformation has taken place within the sneaker industry. What was once a simple market for athletic footwear has evolved into a multibillion-dollar industry driven by sneaker reselling. Sneakerheads and entrepreneurs alike have recognized the potential for significant profits by buying and selling coveted sneakers. In this blog, we'll delve into the fascinating world of sneaker reselling, exploring the reasons behind its growth, the strategies employed by resellers, and the impact it has on the sneaker market as a whole.

In recent years, sneakers have become more than just footwear in streetwear culture. The rise of sneakerheads has turned owning rare and exclusive pairs into a lucrative side-hustle. Some individuals have generated significant revenue, ranging from thousands to millions of dollars, from reselling these coveted shoes. The U.S. sneaker resale market is projected to reach a staggering worth of $30 billion by 2030. Limited supply, exclusivity, and desirability drive the appeal of these sneakers.

The resale market, fueled by high demand and scarcity, plays a crucial role in their valuation. Factors such as celebrity endorsements, collaborations, and unique design elements contribute to their extraordinary value. Sneaker collecting has also emerged as an investment opportunity. Overall, the sneaker market has transformed into a thriving industry driven by passion, fashion, and financial potential.

How Big Is the Sneaker Resale Market?

The global sneaker resale market is currently valued at around $6 billion and continues to experience rapid expansion without any signs of slowing down. Experts predict that this explosive growth will skyrocket to a staggering $30 billion by the year 2030. The demand for limited-edition sneakers is so intense that they often sell for multiple times their original retail price.

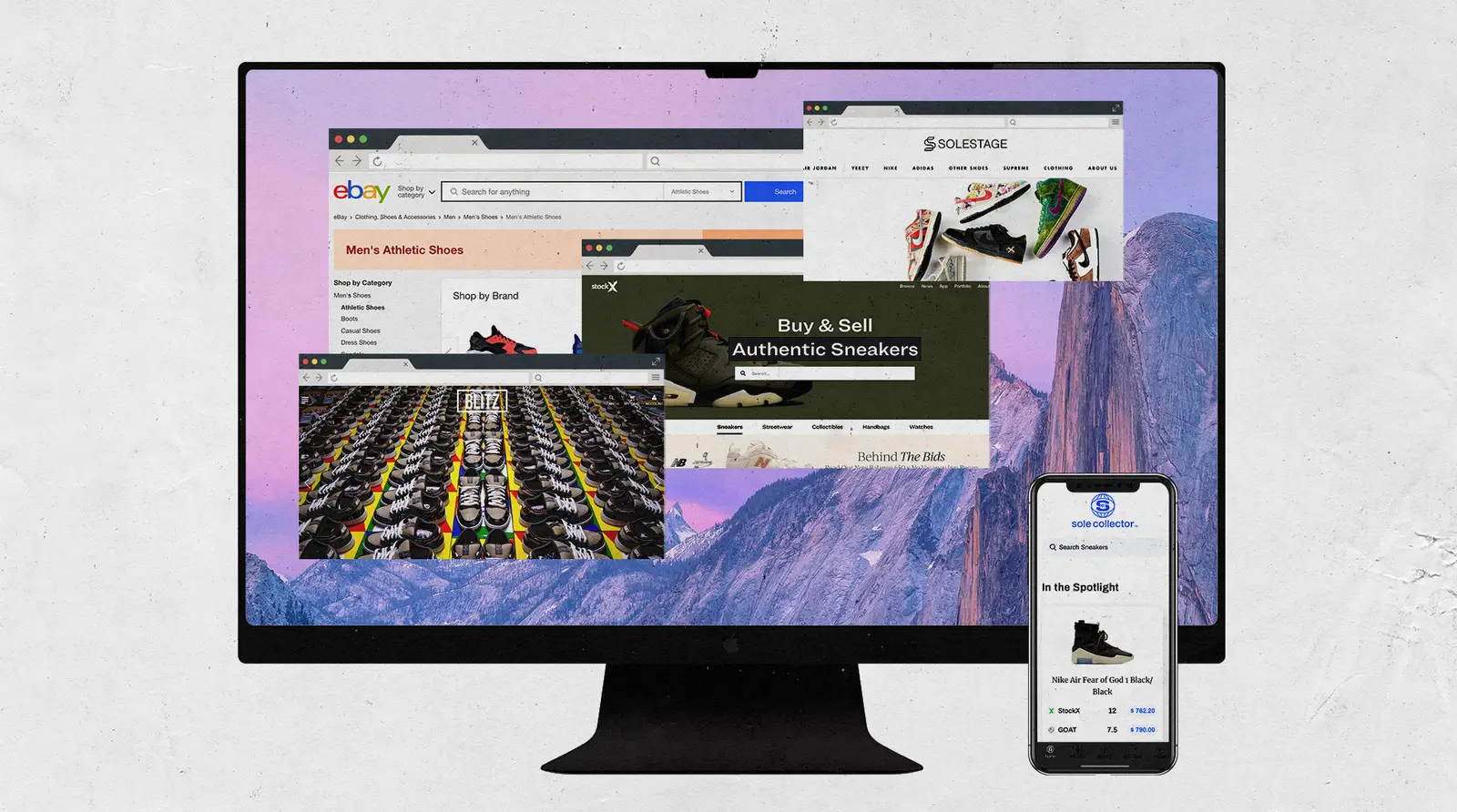

In today's market, sneakers have evolved into a unique asset class, complete with its own stock market. Platforms like StockX have emerged as prominent sneaker reselling hubs, offering a comprehensive tracking system for sneaker values. Comparable to a Wall Street stock ticker, these platforms allow users to monitor the fluctuation in sneaker values over the course of a year. This integration of financial elements brings an intriguing blend of commerce and culture to the sneaker industry. Notably, numerous resellers have even turned their passion for sneakers into a full-time profession, earning a sustainable income solely through their involvement in the market.

Here are three innovative startups that are shaking up the sneaker resale market and an examination of the future of this industry:

dropout

dropout is an Italian retail business that sells limited-edition sneakers and streetwear. The company was founded in 2018 by entrepreneur Kola Tytler. What makes dropout stand out in the resale space is its Hypeanalyzer tool, a free algorithmic tool meant to help people easily find out the price and demand for different limited-edition sneakers and clothes. The tool goes through thousands of shoes and compares them to see which of them has a higher resale value. It does so by factoring in things like consignment rates and discounts. In 2022, dropout had a yearly turnover of EUR 2 million (US$2.15 million).

Kicks Crew

Kicks Crew is an American B2B2C (business to business to consumer) sneaker marketplace founded in 2008. The company works directly with verified sneaker retailers to ensure that buyers can rest easy knowing that they bought an authentic product. Unlike some other sneaker reselling businesses, Kicks Crew doesn’t sell secondhand products. Instead, it purchases overstock and excess inventory from retailers and then resells them to sneakerheads. In 2022, Kicks Crew sells the inventory of 20 different multi-store retailers and raised US$6 million in funding.

GOAT

Founded in 2015, GOAT (Greatest of All Time) is a billion-dollar sneaker reselling marketplace that allows individual sellers to resell sneakers from their collections. The company gets individual sellers to send their products to GOAT’s offices for inspection. Once the product is confirmed to be authentic, it is photographed and listed on GOAT’s website. Its unique selling point is that it offers customers full refunds and insurance for sneaker purchases of over US$300. It even caters to the needs of the sellers by providing them with a refurbishing service for used shoes, helping them sell for a higher price. In 2021, GOAT Group (GOAT’s parent company) raised US$195 million taking its valuation to US$3.7 billion.

Top 3 Most Expensive Sneakers Ever Sold

3. Nike Air Jordan 1s worn by Michael Jordan sold by Sotheby’s

It’s undeniable that Michael Jordan had an impact on popular culture. Notably, Nike’s collaboration with the super-star athlete is still one of the most lucrative ones today. Also, in 1984, Jordan was the first athlete that Nike gave a signature line of shoes and clothes. Similar to the kicks sold by Christie’s, this pair was autographed and sold for a whopping $560,000.

2. Nike Air Jordan 1s worn by Michael Jordan sold by Christie’s

In 2020, auction house Christie’s sold this exclusive pair of Nikes worn by Michael Jordan himself. These shoes became the most expensive trainers ever sold at a grand $615,000. Also, I can’t forget to mention that this pair is autographed and worn during a 1985 game. A fun fact about these kicks is that it’s said that there is a shard of glass lunged in the sole from the match.

1. Nike Air Yeezy 1s worn by Kanye West

Finally, is the grail of all grails, the Air Yeezy 1. West has made countless shoes, but this highly coveted Yeezy is now the most expensive sneaker ever sold at $1.8 million by Sotheby to RARE’s. What makes the shoe so expensive is the fact that West wore these during his 2008 Grammy Awards performance.

The Grammy Air Yeezy samples were built-in Nike’s lab, known as the “Innovation Kitchen” at the company’s headquarters in Beaverton, Oregon. Apparently, Mark Smith kept the sneakers so low-key that he gave the shoes to West for the Grammys with the condition that they would be returned as soon as possible following the performance. Looks like West held up his end of the bargain.

Regional Landscape of Sneaker Resale Market

The sneaker resale market is primarily dominated by North America, with the United States leading the way. Within the U.S., cities such as New York, Los Angeles, and Chicago have emerged as hotspots with active sneaker marketplaces and a thriving customer base. In Europe, the market is slightly smaller but still significant and experiencing notable growth. Cities like London, Paris, and Berlin are particularly noteworthy, given their strong sneaker communities and the emergence of boutiques and resellers. The Asia-Pacific (APAC) region is an upcoming market poised for potential growth in the coming years. Countries such as China, Japan, India, and South Korea are witnessing a surge in demand for both international and local sneaker brands, fueled by a burgeoning sneakerhead community. In the Middle East, countries like the UAE and Saudi Arabia stand out due to their high disposable incomes and a growing desire for luxury goods, making them prosperous markets in the sneaker industry.

Deadstock in the Right Hands is New Stock

Deadstock, as its name suggests, refers to unsold stock that has remained untouched and is in new condition. These are the sneakers that never found a buyer and instead were stored in shops, gradually transforming into vintage treasures that gain value over time. For sneakerheads, these deadstock pairs are considered highly valuable and sought after. Renowned e-marketplaces like StockX and GOAT recognize their appeal and acquire them, subsequently selling them at a premium price. It's not just the untouched appearance and nostalgic sentiment that attract sneakerheads; they also place great importance on the original packaging and accompanying accessories, which add to the timeless allure of these shoes. If necessary, resellers may provide the required care and restoration to ensure these retro pairs are in optimal condition before presenting them to the market for sale.

The Impact of Technology on Sneaker Resale in 2023

Advancements in technology have made it easier for resellers to acquire inventory, but they've also made it harder to compete. Bots and automation software can purchase sneakers faster than any human can, giving those who use them an unfair advantage. Additionally, social media has made it easier for resellers to market their products, but it's also created a saturated market where it's hard to stand out.

One of the key ways technology is expected to affect the industry is through the use of artificial intelligence and machine learning. AI-powered tools can help sneaker resellers accurately price and value their inventory, by analyzing data from past sales and current market trends. This can lead to more informed pricing decisions and better profitability for resellers.

Technology on Sneaker Resale

When it comes to counterfeit sneakers in the market, blockchain technology, for example, can be used to create a secure and transparent record of a sneaker's authenticity, making it more difficult for counterfeiters to pass off fake sneakers as genuine.

Furthermore, mobile applications and online marketplaces are expected to continue to be a major driver of the sneaker resale industry, as consumers increasingly turn to these platforms to buy and sell their sneakers. These platforms can offer resellers a wider reach and greater convenience, while also making it easier for buyers to find the sneakers they are looking for. Goat, StockX, eBay, Grailed, and many more will be marketplaces to keep up with.

Challenges Ahead for the Sneaker Resale Market

During the COVID-19 pandemic, sneakers were treated as speculative assets and saw a surge in investment, similar to cryptocurrency and non-fungible tokens (NFTs). However, as the pandemic bubble burst, the demand for sneakers decreased. Research firm Altan Insights analyzed data from resale platform StockX and found that the average return value of new sneaker collections dropped by 7%. Factors contributing to this decline include the fallout from the Kanye West situation, with brands like Adidas severing ties with him, and incidents like a devoted Yeezy fan publicly burning his $15,000 Yeezy shoe collection. Additionally, in October 2022, Nike implemented measures to crack down on sneaker resellers using bots, imposing purchase limits and introducing restocking fees to discourage mass purchasing and returns.

Has the Sneaker Resale Market reached its tipping point?

The sneaker resale market has not completely collapsed despite recent changes. High-priced sneakers, such as the Air Jordan 1 (Black and Gold) and limited-edition Nike "Freddy Krueger" Dunk Lows, continue to maintain their resale value. Projections suggest that the market could be worth $30 billion by 2030. Resellers are adapting by diversifying their offerings and implementing strategic approaches. For example, GOAT acquired Grailed to expand into clothing resale, and StockX introduced a discounted section on its platform. The future of the sneaker resale market remains uncertain, and only time will determine the success of these strategies.

The Future of Sneaker Resale

Despite the challenges, opportunities still exist for resellers in the sneaker resale industry. They can focus on sneakers with a dedicated fanbase and offer better customer service to stand out. The future of the industry remains uncertain, but adaptable resellers can still find success by staying informed and addressing challenges. The sneaker reselling market is projected to reach $30 billion in a few years, driven by the growth of streetwear fashion and the demand for limited-edition sneakers. In summary, the industry is expected to continue thriving in 2023 and beyond.

How is Perceiving a Career in Sneaker Reselling Industry?

Sneakerheads, who hold a deep love for shoes and nostalgic connections to their favorite pairs from childhood, may perceive sneakers as simple artifacts like marbles or yo-yos. However, the sneaker reselling industry has embraced big data as a central component, similar to other sectors. Obtaining a single pair of highly sought-after shoes during a hyped release has become nearly impossible without the assistance of sneaker bots, let alone acquiring multiple pairs for resale.

Web scraping also plays a crucial role in gathering valuable data about the sneaker reselling market and customer preferences. Analyzing buying patterns and identifying the most popular sneakers empowers resellers to make informed and strategic business decisions. This integration of data-driven insights contributes significantly to the success of a sneaker reselling operation.

Conclusion:

Sneaker reselling has transformed the sneaker industry into a multibillion-dollar market, driven by limited supply, high demand, and entrepreneurial spirit. It has created opportunities for individuals to turn their passion for sneakers into profitable ventures. However, it also poses challenges and controversies related to accessibility and market integrity. As the sneaker market continues to evolve, it will be interesting to see how brands, retailers, and consumers navigate the complexities of this thriving reselling ecosystem.