Unlocking the Secrets of Swiss Banks: A Closer Look

The fascinating world of Swiss banks, exploring their history, the reasons behind their globalization and Controversies.

Swiss banks are no longer unfamiliar to many people because of its prestige, nowadays many global entrepreneurs doing business in Europe choose Swiss banks to open an offshore bank account.These institutions, often associated with wealth, discretion, and stability, have captured the imagination of people around the world. In this blog post, we delve into the fascinating world of Swiss banks, exploring their history, the reasons behind their globalization and Controversies.

Introduction

Swiss Bank Corporation was a Swiss investment bank and financial services company located in Switzerland. Prior to its merger, the bank was the third largest in Switzerland, with over CHF 300 billion of assets and CHF 11.7 billion of equity.Throughout the 1990s, SBC engaged in a large growth initiative, shifting its focus from traditional commercial banking into investment banking, in an effort to match its larger Swiss rival Credit Suisse. In 1998, SBC merged with Union Bank of Switzerland to form UBS, the largest bank in Europe and the second largest bank in the world. The company's logo, which featured three keys, symbolizing "confidence, security, and discretion", was adopted by UBS after the 1998 merger. Although the combination of the two banks was billed as a merger of equals, it quickly became evident that from a management perspective, it was SBC that was buying UBS.

History of Swiss Bank Corporation

The history of Swiss banking can be traced back to the Middle Ages when merchants from northern Italy and southern Germany would travel to Switzerland to conduct their business transactions. The Swiss were known for their neutrality and were considered a safe place to store money and valuables during times of war and political unrest. In the 18th century, the country's banks began to expand, catering to a growing number of wealthy clients from across Europe. Swiss banks became renowned for their reliability, secrecy, and discretion.

Swiss Bank Corporation, former Swiss bank, one of the largest banks in Switzerland until its merger with the Union Bank of Switzerland in 1998. The Swiss Bank Corporation was established in 1872 as the Basler Bankverein, specializing in investment banking. In an 1895 merger with Zürcher Bankverein, it became a commercial bank and changed its name to Basler und Zürcher Bankverein, and in 1897, after absorbing two other banks, it became the Swiss Bank Corporation. In 1998 the Swiss Bank Corporation merged with the Union Bank of Switzerland to form UBS AG, which became one of the largest banks in the world.

The Legacy of Swiss Banking

Swiss banking secrecy is a professional secret that protects client data, and it is comparable to attorney-client privilege. It protects all the data and information related to the account relationship of bank clients. Nonresidents of Switzerland must be at least 18 years old to open a Swiss bank account, and that's about the only restriction. The main benefits of Swiss bank accounts include low levels of financial risk and high levels of privacy. Swiss law prevents the bank from disclosing any information regarding an account (even its existence) without the depositor's permission, except in cases where severe criminal activity is suspected.

USD deposits monthly in swiss bank

Banking Secrecy

Swiss banking secrecy was first codified with the Banking Act of 1934, thus making it a crime to disclose client information to third parties without a client's consent. The law, coupled with a stable Swiss currency and international neutrality, prompted large capital flight to private Swiss accounts. Switzerland, considered the "grandfather of bank secrecy", has been one of the largest offshore financial centers and tax havens in the world since the mid-20th century.

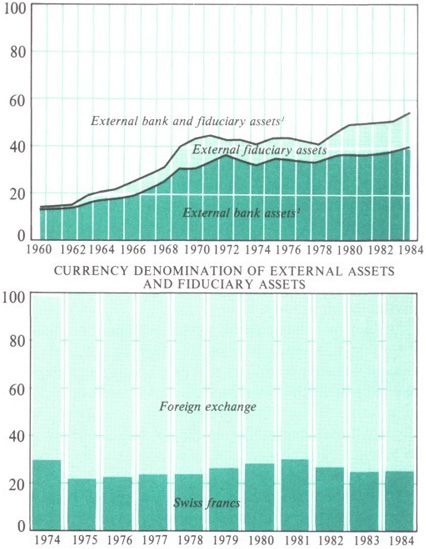

The Swiss Bankers Association estimated in 2018 that Swiss banks held US$6.5 trillion in assets or 25% of all global cross-border assets. These secrecy laws have linked the Swiss banking system with individuals and institutions seeking to illegally evade taxes, hide assets, or generally commit financial crime. While it is true that Swiss banks historically offered a high level of confidentiality, international pressure and changing regulations have eroded this traditional secrecy over the years. Switzerland has taken steps to align its banking practices with international standards, particularly in the areas of tax evasion and money laundering.

The End of Banking Secrecy

The disclosures prompted a national debate in Switzerland, even though the much-heralded “end of banking secrecy as we know it” was supposed to have occurred in 2014, when ministers from 50 countries and territories agreed to a global exchange of information about their respective taxpayers’ financial information for the first time. Among them are all important financial centers. The first automatic exchange of information took place in 2018 of the law introduced in 2017. There are no agreements with the remaining 90 countries, most of them developing countries.

Swiss banking secrecy has ended for tax matters with the AEOI since 2017, but only for just over 100 signatory countries. In other areas of privacy, Swiss banking secrecy laws still apply (see “Financial Secrecy Index 2022” at the end). However, Swiss banks still offer the highest level of client confidentiality in the world according to the Financial Secrecy Index 2022.

International Expansion

Swiss banks have a global presence, and UBS operates in over 50 countries and from all major international financial centers. Credit Suisse is organized into four divisions – Wealth Management, Investment Bank, Swiss Bank and Asset Management – and four geographic regions – Switzerland, Europe, Middle East and Africa (EMEA), Asia Pacific and Americas. Citi has also recently launched a broad new commercial banking offering in Switzerland as part of the firm's multi-year plan to scale up and fast-track growth in key markets. Here are some reasons for the international expansion of Swiss banks:

- Reputation for stability and security: Swiss banks are renowned for their stability and security, which attracts wealthy clients from around the world who want to preserve their wealth. This has led to an increase in demand for Swiss banking services

- Access to new markets: As Swiss banks seek to grow their business, they often expand into new markets to reach new clients and tap into new sources of revenue. Through their international expansion, Swiss banks have gained access to new markets in Asia, the Middle East, and beyond.

- Diversification of revenue streams: By expanding into new markets and offering a wider range of financial services, Swiss banks have been able to diversify their revenue streams and reduce their dependence on any single market or product.

- Globalization of the financial industry: As the financial industry has become increasingly globalized, Swiss banks have followed suit by expanding into key financial centers around the world. This allows them to better serve their clients who have interests in multiple countries and to stay competitive in an increasingly crowded industry.

- Tax implications: While it is often associated with negative connotations, Swiss banks' reputation for confidentiality and privacy has been attractive to many clients who seek to manage their tax liabilities.

Controversies and Scandals of swiss bank

Controversies and Scandals

A global media investigation revealed that dozens of international entities, including heads of state, intelligence officials, drug lords and sanctioned businessmen, publicly known for their involvement in human rights abuses, drug trafficking, corruption, money laundering and other serious crimes, stashed away funds in Credit Suisse. The banks were also criticized for their role in holding assets stolen by the Nazis during World War II. In recent years, Swiss banks have been fined billions of dollars by regulators in the United States and Europe for their involvement in various illegal activities.

. February 2020: A spying scandal topples the CEO

. March 2021: Greensill Capital collapses and Credit Suisse loses money

. March 2021: Archegos defaults and Credit Suisse loses money, again

. October 2021: A hefty fine over dirty dealings in Mozambique

. January 2022: The fix-it guy leaves after nine months

. February 2022: The Suisse Secrets data leak

. March 2022: A Bermuda judge's $553 million ruling against Credit Suisse

. June 2022: Bulgarian cocaine money laundering

. October 2022: Another attempt at a turnaround

. February 2022: Credit Suisse reports massive outflows

FAQ

- What is the Swiss Franc (CHF)?

The Swiss Franc (CHF) is the official currency of Switzerland.

2. Are Swiss banks regulated?

Yes, Swiss banks are subject to rigorous regulation by FINMA and must adhere to international banking standards.

3. Can non-residents open accounts with Swiss banks?

Yes, Swiss banks often accept non-resident clients

4. What is the future of Swiss banking?

The future of Swiss banking involves continued international expansion, a focus on digitalization and a shift toward sustainable and ethical investment opportunities.

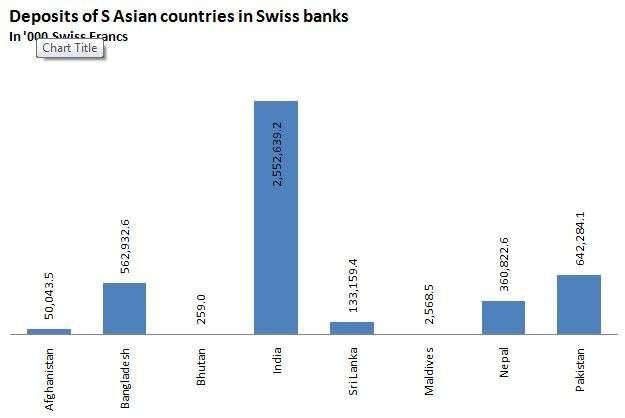

5. Why black money is stored in Swiss bank?

They require large deposits, and depositors require confidentiality; it is a mutually beneficial deal.

Conclusion

Swiss banks have a rich history and continue to play a significant role in the global financial landscape. While the era of absolute banking secrecy has passed, these institutions remain synonymous with stability and financial expertise. Clients seeking wealth management and financial services can still find value in Swiss banks' offerings, backed by the country's strong regulatory framework.