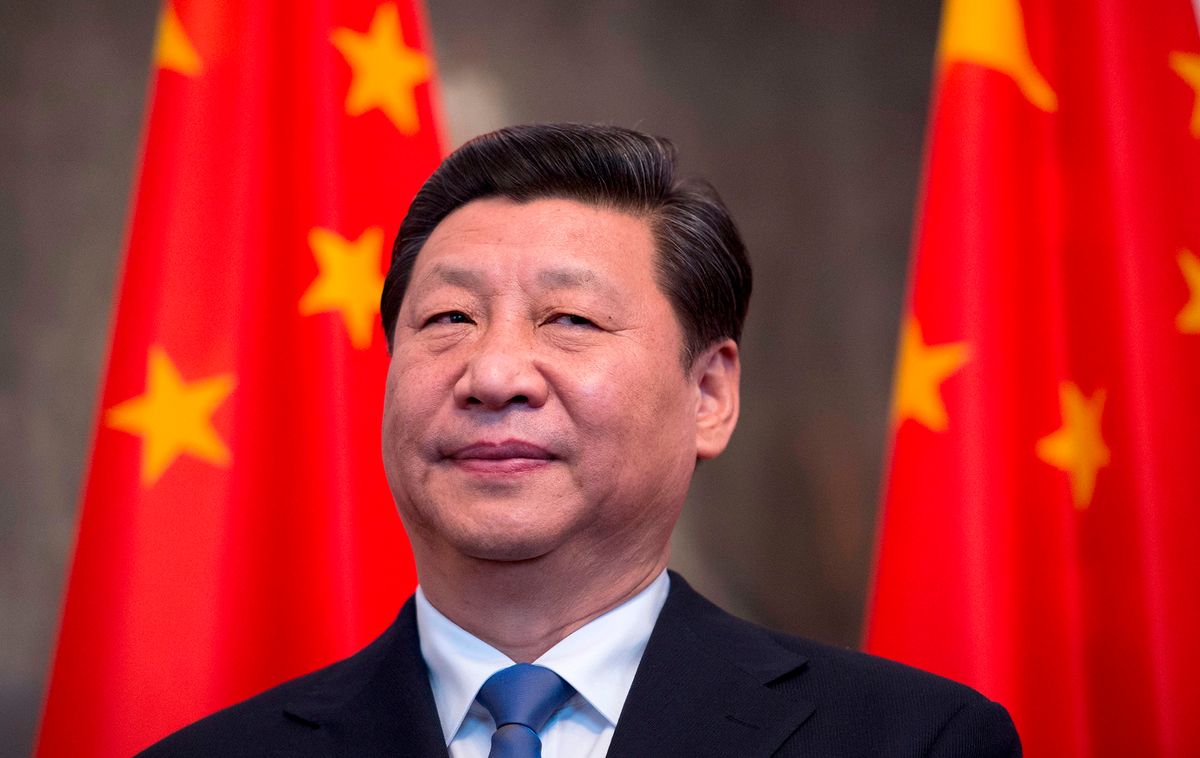

Xi Jinping's Strategic Takeover of China's Stock Market

Xi is prioritizing the IPO market, with a focus on sectors like semiconductor manufacturing, biotech, and electric vehicles.

Introduction

In recent years, China's stock market has been going through a transformation that has caught the attention of both domestic and international investors. President Xi Jinping's administration has been implementing a series of policies and shifts in strategy that are reshaping the landscape of China's capital markets. This blog explores how Xi Jinping is taking control of China's stock market and the implications of this transformation.

The Changing Face of China's Stock Market

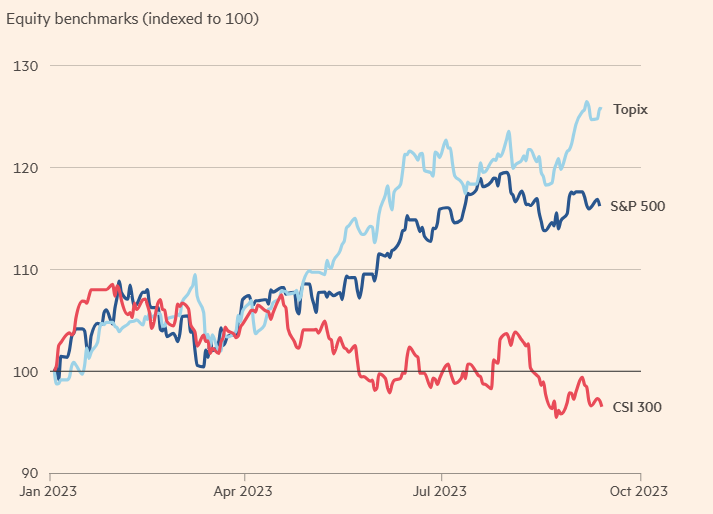

The recent debut of Jilin Joinature Polymer on the Shanghai Stock Exchange may appear as a typical IPO, but it represents a fundamental shift in China's approach to its stock market. In 2022, more than 200 companies went public on China's domestic markets, raising over $40 billion. This remarkable surge in IPO activity comes at a time when the benchmark CSI 300 index has been struggling, down 14 percent since the beginning of the year.

This apparent paradox is a result of a deliberate strategy by President Xi Jinping and his administration. Xi aims to direct capital towards sectors aligned with China's priorities, such as national security, technological self-sufficiency, and strategic control. In doing so, he is using the stock market as a tool to reshape China's economy.

A Shift in Economic Strategy

Xi's approach marks a significant departure from previous administrations' pro-market stance. While he initially espoused a more market-oriented approach when he came to power in 2012, his current strategy places party policy above profit. The goal is to reduce China's dependence on property and infrastructure development as drivers of economic growth.

Instead, Xi is prioritizing the IPO market, with a focus on sectors like semiconductor manufacturing, biotech, and electric vehicles. By encouraging companies in these strategic sectors to go public, they can scale up and contribute to the growth in consumer spending, filling the gap left by the slowing property market.

The Role of Government Guidance

To achieve these goals, Xi's administration has taken several steps. One key development is the "registration-based" listings system introduced in February, which made the process for stock market listings more transparent and streamlined. But perhaps even more crucial is the "traffic light" system, where regulators informally instruct Chinese investment banks on which companies should be allowed to list.

Companies in strategically important industries receive a "green light," while those in low-priority sectors are given a "red light," effectively prohibiting them from going public. This approach allows the government to guide capital towards its chosen sectors.

Challenges and Concerns

While Xi's strategy is ambitious, it's not without challenges and concerns. The flood of new listings has put downward pressure on the valuations of existing stocks, which has prompted the securities regulator to slow the pace of new listings to boost investor confidence. Regulators have also implemented measures to stabilize share prices and prevent immediate sell-offs by investors.

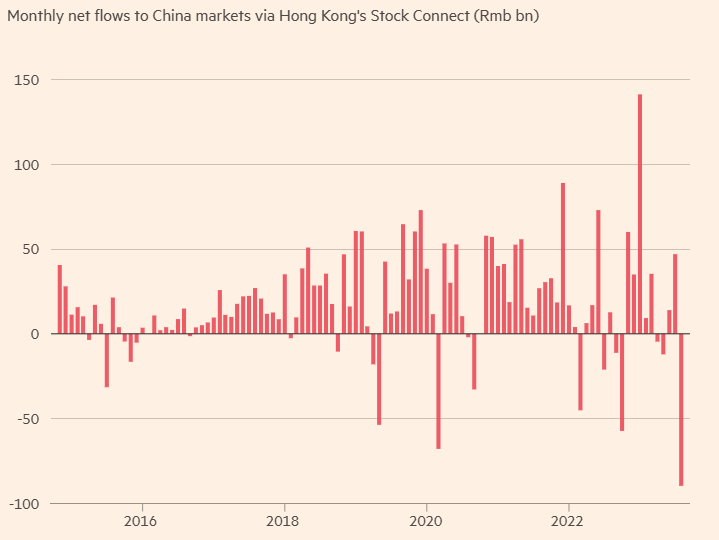

Foreign investors have been selling Chinese equities at a record pace, raising concerns about the long-term appeal of Chinese stocks. This mass exodus undermines efforts to attract foreign capital and has prompted China's "national team" of state-run investors to step in and support the market.

The Uncertain Future

Xi Jinping's vision for China's stock market is clear: use it as a tool to drive economic growth in strategically important sectors. However, whether this strategy will deliver the desired results remains uncertain.

Economists point out that the tech sectors favored by Beijing may not generate the employment opportunities or consumer spending levels anticipated by Chinese leaders. Additionally, there are concerns about the sustainability of investments in these sectors.

As China's stock market undergoes this transformation, questions linger about the balance between market forces and government control. Xi's commitment to steering the market in a particular direction reflects his desire for self-sufficiency and political control, but it may come with limitations.

The Global Implications

Xi Jinping's approach to China's stock market not only impacts the country itself but also has global implications. China's growing influence in the global economy, combined with its increasingly assertive policies, means that the world is closely watching these developments.

One of the notable effects of Xi's strategy is the response of foreign investors. As they continue to sell Chinese equities at a record pace, it raises questions about China's ability to attract and retain international capital. This trend undermines efforts to integrate Chinese securities into global benchmarks, which had been a long-term goal. The risk is that international investors may perceive China's stock market as less attractive due to increasing government intervention.

Furthermore, the emphasis on strategic sectors like semiconductors, electric vehicles, and high-end manufacturing reflects China's aspiration for self-sufficiency in critical industries. However, this approach could lead to concerns about global competition and cooperation. China's aggressive pursuit of technological advancement may raise questions about fair trade practices, intellectual property rights, and international standards.

Balancing Act

Xi Jinping's strategy for China's stock market is a balancing act. On one hand, he seeks to exert greater control and direct capital toward strategic sectors. On the other hand, he acknowledges the importance of market mechanisms. Striking this balance is crucial to the success of his vision.

However, the challenges are formidable. Managing market expectations, preventing excessive speculation, and ensuring sustainable growth in strategic sectors are no small tasks. Moreover, China's stock market has a history of volatility and unpredictability, which adds another layer of complexity to the equation.

Conclusion

In conclusion, Xi Jinping's strategy to take control of China's stock market is reshaping the country's economic landscape. While it is a bold move with significant implications, the success of this endeavor remains uncertain, and the evolving relationship between the government and the market will continue to be a topic of global interest and scrutiny.